PEGACPDC25V1 Certified Pega Decisioning Consultant 25 Questions and Answers

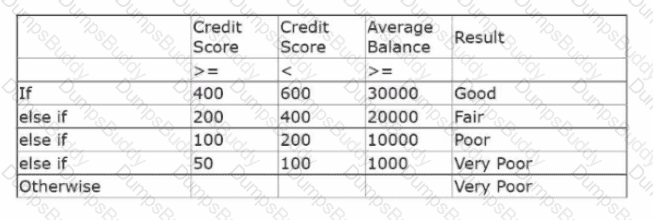

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning architect, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hub™.

Using the decision table, which label is returned for a customer with a credit score of 240 and an average balance 35000?

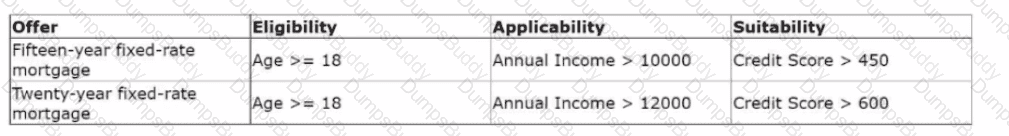

U+ Bank, a retail bank, has recently implemented a project in which qualified customers see mortgage offers when they log in to the web self-service portal.

Currently, only the customers who satisfy the following engagement policy conditions receive the Fifteen-year fixed-rate mortgage offer:

The bank decides to make two changes:

1. Update the suitability condition for the Fifteen-year fixed-rate mortgage offer.

2. Introduce a new offer , Twenty-year fixed-rate mortgage.

The following table shows the new engagement policy conditions for both mortgage offers:

What is the best practice to fulfill this change management requirement in the Business Operations Environment?

You are the decisioning architect on an Al-powered one-to-one customer engagement implementation project. You are asked to design the next-best-action prioritization expression that balances the customer needs with the business objectives.

What factor do you consider in the prioritization expression?

As a decisioning architect, how can you optimize the strategies that are based on Insights that you gain from the AI Insight feature in the Customer Profile Viewer?

Acme Retail uses Pega Customer Decision Hub™ to present various offers to its customers. The company notices that some high-value customers are not receiving any offers. The marketing team wants to identify these underserved customers.

Which tool in Pega Customer Decision Hub can Acme Retail use to identify segments of customers who are not receiving relevant offers?

A declsioning architect wants to use the customer properties Gender and MonthlyAverageUsage in a Data Join component. Which decision component is required to enable access to these properties?

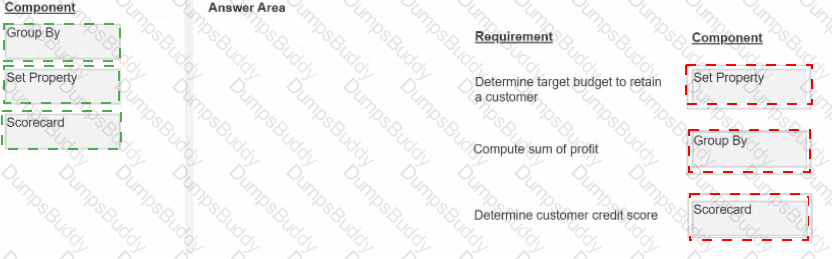

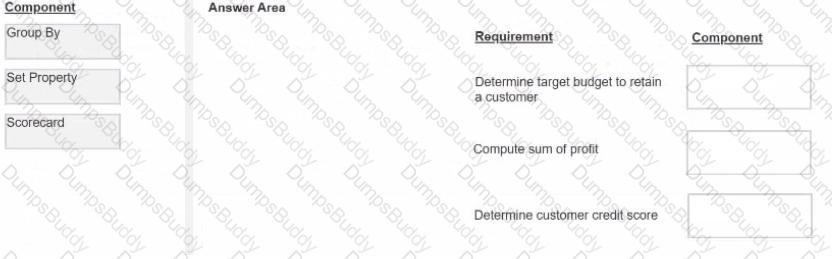

You are a decisioning architect on a next-best-action project and are responsible for designing and implementing decision strategies. Select each component on the leftand drag it to the correct requirement on the right.

Myco Bank, a retail bank, uses the Customer Engagement Blueprint to design personalized customer journeys. The bank wants to better understand its diverse customer base to create more targeted engagement strategies.

What key achievement does the Personas stage provide for Myco Bank when implementing with Customer Engagement Blueprint?

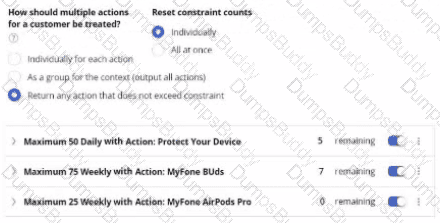

In the following figure, a volume constraint uses the Return any action that does not exceed constraint mode with the three following action type constraints that have remaining limits:

1.Maximum 50 Daily with Action: Protect Your Device, 5 remaining

2.Maximum 75 Daily with Action: MyFone Buds, 7 remaining

3.Maximum 25 Daily with Action: MyFone AirPods Pro, 0 remaining

A customer, CUST-01, qualifies for all the three actions. Given this scenario, how many actions does the system select for CUST-01 in the outbound run?

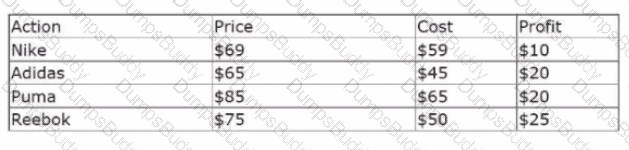

The following decision strategy outputs the most profitable shoe a retailer can sell. The profit is the selling Prices of the shoe, minus the Cost to acquire the shoe.

The details of the shoes are provided in the following table:

The details of the shoes are provided in the following table:

To output the most profitable shoe, which component do you add in the blank space that is highlighted in red?

A financial services company has implemented always-on outbound campaigns for three credit card offers: Standard card. Rewards card, and Rewards Plus card. The marketing team observes that customers who are qualified for multiple actions receive different numbers of offers, depending on the configuration of the volume constraint mode. To optimize customer engagement, the system administrator must choose between constraint modes.

Which volume constraint mode ensures that customers receive all actions for which they qualify, provided the actions do not reach volume limits?

MyCo, a telecom company, wants to Include offer-related images in the emails that they send to their qualified customers. As a decisioning architect, what best practice do you follow to include images in emails?

A financial institution's NBA team discovers that they need to modify their risk assessment strategy and edit a scorecard used for loan approvals. The team lead reviews the available options in 1:1 Operations Manager to determine the most appropriate approach to implementing these changes.

Which approach should the team lead use to implement these strategy and scorecard modifications?

Pega Customer Decision Hub enables organizations to make Next-Best decisions. To which type of a decision is Next-Best-Action applied?

MyCo,a telecom company, recently introduced a new mobile handset offer, MyFone 14 Pro, for its premium customers. As the bank has financial targets to meet, the business decides to boost the MyFone 14 Pro offer.

As a decisioning architect, how can you ensure that the MyFonel4 Pro offer is prioritized over other offers7

U+ Bank wants to use Pega Customer Decision Hub"* to display a credit card offer, the Standard Card, to every customer who logs in to the bank website.

What three of the following artifacts are mandatory to implement this requirement? (Choose Three)

A financial institution has created a new policy that states the company will not send more than 500 emails per day. Which option allows you to implement the requirement?

As shown in the following figure, decision strategy contains 'Green Label' and 'Black Label' Proposition components that point to the "Set Printing Cost' Set Property component that uses 'BaseCost' and "LetterCount." The configuration of the Prioritize component selects the lowest cost. What is the role of the Set Property component in the following decision strategy?

U+Bank presents various credit card offers to Its customers on Its website. The bank uses AI to prioritize the offers according to customer behavior. After the introduction of the Gold credit card offer, the offer click-through propensity decreased to 0.42.

What does the decrease in the propensity value most likely indicate?

Which of the following reasons explains why a customer might receive an action that they already accepted?

U+ Bank follows all engagement policy best practices to present credit card offers on their website. The bank has introduced a new credit card offer, the Rewards card. Anna, an existing customer, currently holds a higher value card, Premier Rewards, and does not see the new Rewards card offer.

What condition possibly prevents Anna from seeing the new Rewards card offer?

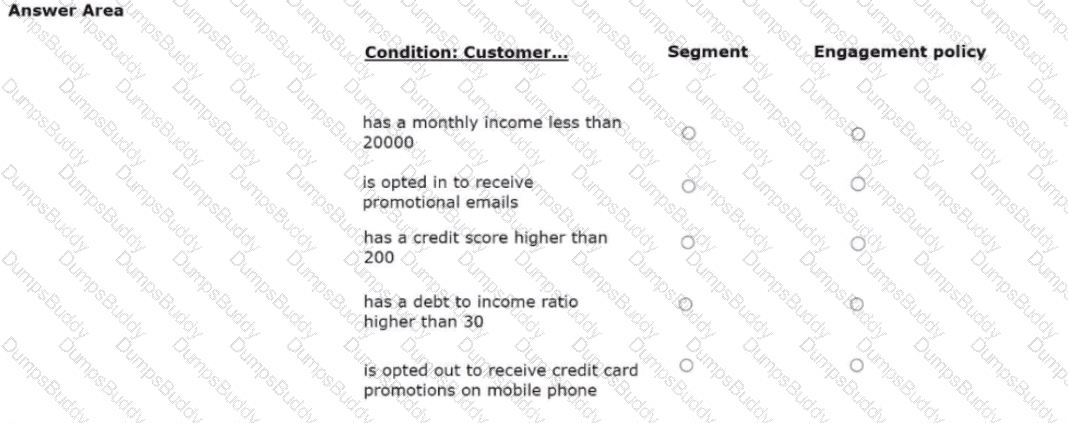

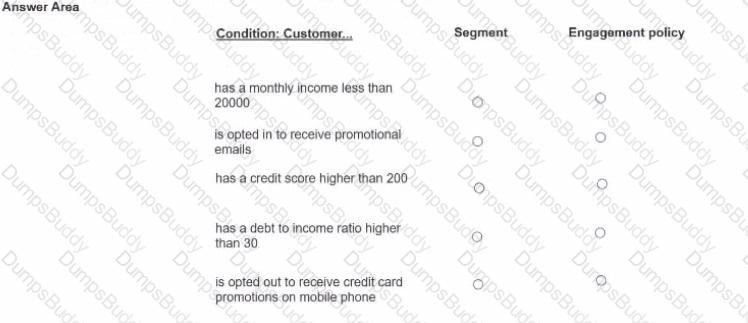

U+ Bank's marketing department wants to use the always-on outbound approach to send promotional emails about credit card offers to qualified customers. As a part of this promotion, the bank wants to identify the starting population by defining a few high-level criteria in a segment.

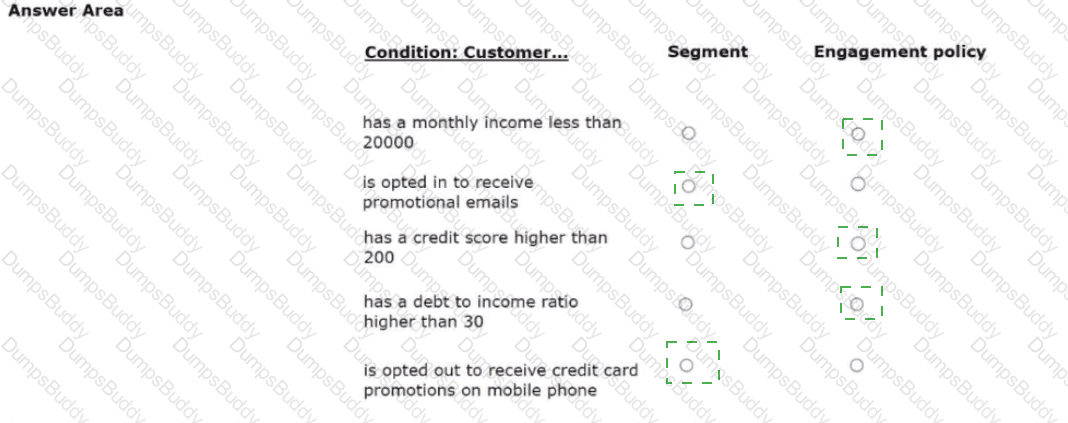

For each condition below, select which two conditions should be defined in Segment and which three conditions should be defined in Engagement policy as best practice.

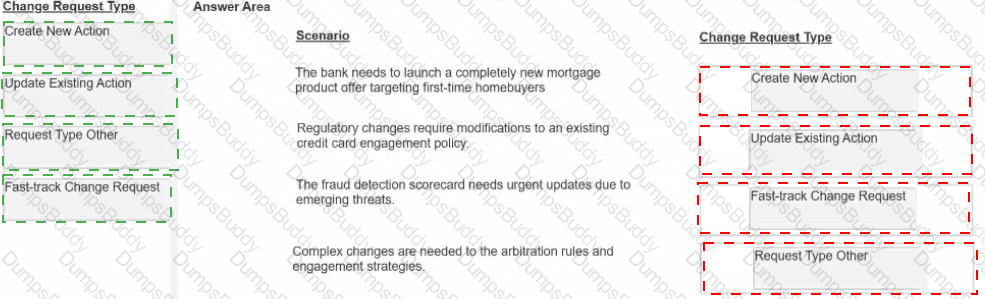

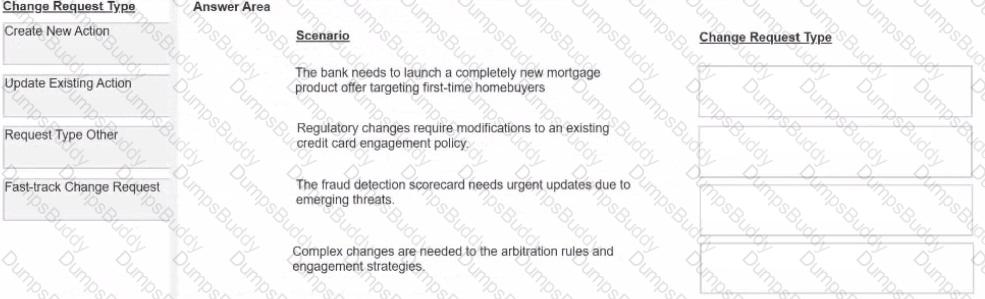

U+ BankT a retail bank, uses Pega Customer Decision Hub™ to manage various business changes throughout their operations The bank's team members need to understand which change request type to use tor different business scenarios they encounter

Select each change request type on the left, and drag it to the matching scenario descriptions on the right:

U+ Bank, a retail bank, is currently presenting a cashback offer on its website.

Currently, only the customers who satisfy the following engagement policy conditions receive the cashback offer:

While continuing cross-selling on the web, the bank now wants to present the cashback offer through a new channel, SMS. The bank also wants to update the suitability condition by lowering the threshold of the debt-to-income ratio from 48 to 45.

As a business user, what are the two tasks that you define to update the cashback offer? (Choose Two)

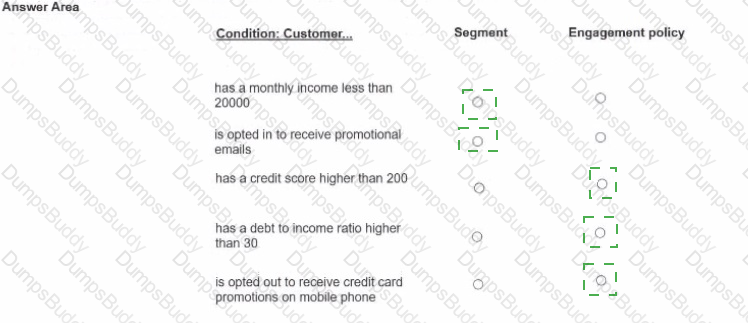

U+ Bank's marketing department wants to use the always-on outbound approach to send promotional emails about credit card offers to qualified customers. As a part of this promotion, the bank wantsto identify the starting population by defining a few high-level criteria ina segment.

For each condition below, select which two conditions should be defined in Segment and which three conditions should be defined in Engagement policy as best practice

As a Customer Service Representative, you present an offer to a customer who called to learn more about a new product. The customer rejects the offer. What is the next step that Pega Customer Decision Hub takes?

A mortgage company defines a new suppression policy to limit promotional emails for home loan offers. The policy is complete, but it must be applied to all to home loan actions. The implementation team must associate this policy with the appropriate business structure.

Where should the team associate the contact policy to apply it to home loan promotions?

In the Impact Analyzer tool, what does It mean when the overall health Indicator of the next best action has a red highlight?