BA3 Fundamentals of financial accounting Questions and Answers

An organization's trial balance at the end of the month was out of agreement, with the debit side totaling £500 less than the credit side. A suspense account was opened for this amount.

During the next month, the following errors were discovered:

(a) The purchase returns day book had been under cast by £50

(b) Rent payable of £400 had been credited to the rent receivable account

(c) A non-current asset, with a net book value of £700 had been disposed of at a loss of £80; all entries had been correctly recorded except that the sale proceeds had been omitted from the disposals account.

Following the correction of these errors, the balance on the suspense account would be.

Your organization paid $120250 in net wages to its employees during the year.

Employees' tax and national insurance amounted to $32000 and employers national insurance was $11000. Employees had contributed $6250 to a superannuation scheme.

The amount to be charged against profits for the year, in respect of wages is

Refer to the Exhibit.

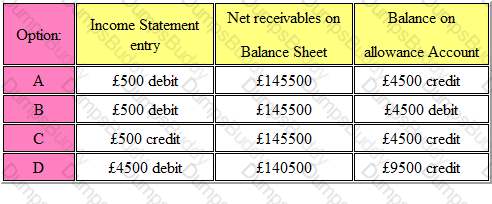

At the beginning of the year, the balance on the allowances for receivables account was £5000, representing 2% of receivables. At the end of the year, receivables amounted to £150000, but it was decided that the provision should be increased to 3% of receivables.

Which of the following set of figures would result?

The answer is:

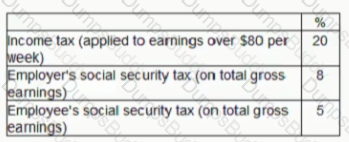

EFG pays employees $10 per hour The following rates of tax and social security are applicable.

An employee works 38 hours in a week.

What is the amount employee receives for one week’s work? Given you answer to the nearest $.

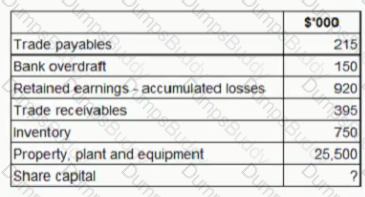

The balances of the trial balance of CDE for the year ended 31 May 20X4 is as follows

What must the balance on the share capital account be at 31 May 20X4 if the trial balance is to balance? Give your answer in $’000

STU has an accounting period end of 31 December 20X8 During the year STU paid $4,800 for business insurance to cover the year to 30 June 20X9 The amount paid for business insurance for 30 June 20X8 was $4,500.

What is the insurance expense to be recognized in the statement of profit or loss of STU for the year ended 31 December 20X8? Give your answer to the nearest $

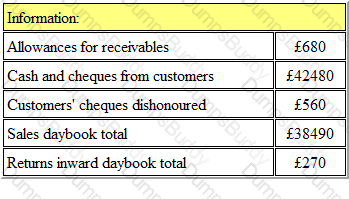

Refer to the Exhibit.

You have been asked to prepare the sales ledger control account for the month of May, using the following information:

According to the accounts the opening receivables balance was £ 66,250

What is the closing receivables balance as at the end of May?

Which one of the following would not contribute to the prevention and detection of fraud?

Which of the following methods of inventory valuation is not acceptable in the UK for financial reporting purposes?

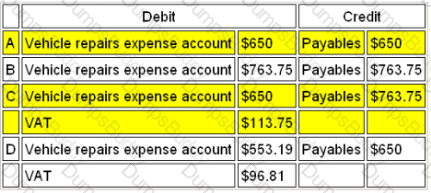

Refer to the Exhibit.

A company which is not VAT-registered received an invoice for vehicle repairs of $650 excluding VAT. The rate of VAT on the invoice was 17.5%.

Which of the following ledger entries to record the invoice are correct?

The correct ledger entries are.

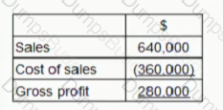

An extract from PQ's statement of profit or loss for the year ended 31 March 20X6 is shown below:

What is the mark-up percentage that PQ applies in arriving at its selling price? Give your answer to one decimal place

A business buys a new production line at a cost of £100,000. After using the line for one year a more advanced version of the line is marketed by the manufacturer. As a result the production line in operation has a market value of £ 50,000. The line is being depreciated straight line over five years.

The charge to the income statement for impairment of the production line will be

At the beginning of the year, an organization’s non-current asset register showed a total net book value for fixed assets of £86,000. The nominal ledger showed non-current assets at cost of £120,000 and provision for depreciation of £39,000.

The disposal of a non-current asset for £10,000, at a profit of £2,000, had not been accounted for in the non-current asset register.

After correcting for this, the net book value shown in the ledger accounts would be

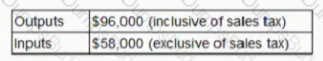

ABC has the following summary of transactions for the quarter ended 30 June 20X9 ABC is registered for sales tax at 20%.

At the beginning of the quarter ABC owed $2,300 to the local tax authority.

What is the balance owing to the local tax authority at 30 June 20X97 Give your answer to the nearest dollar.

The sales ledger control account shows a balance of £236,725, whilst the individual customer balances total £231,472.

One possible explanation for the difference between the two may bE.

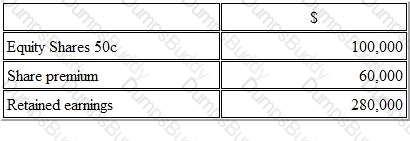

Refer to the exhibit.

A company has the following equity balances at the beginning of the year

During the year the company made a rights issue of 1 for 5 at a price of $1.50

The balance of share premium after this issue is

Which FOUR of the following should be categorised as a DEBIT (DR) when filling out a T-account?

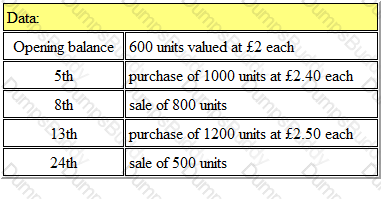

Refer to the Exhibit.

Your organization uses the Weighted Average Cost method of valuing inventory.

During a particular month, the following inventory details were recorded:

The value of the inventory at the end of the month was

An organization restores its petty cash balance to £350 at the end of each month.

During October, the total expenditure column in the petty cash book was calculated as being £310, and hence the impress was restored by this amount. The analysis columns, which had been posted to the nominal ledger, totaled only £300.

This error would result in:

Accounting standards are used to produce the financial statements of all business entities.

Which ONE of the following best describes why accounting standards are needed?

Refer to the Exhibit.

A company has the following chart of accounts:

The sales director of the northern region wants to know what the total sales of widgets are for the first quarter of the year.

Which code would he request for his report?

It underpins all accounting standards and provides the platform from which all future standards will be developed.

Which ONE of the following is described above?

Company A has a receivables turnover ratio of six times, while Company B, which operates in the same market sector, has a receivables turnover ratio of five times.

This suggests that

An invoice for electricity has been debited to the supplier's account and credited to the electricity account. This would result in:

The accounting concept to be considered when the owner of a business uses business funds to pay for his private household expenses, is the:

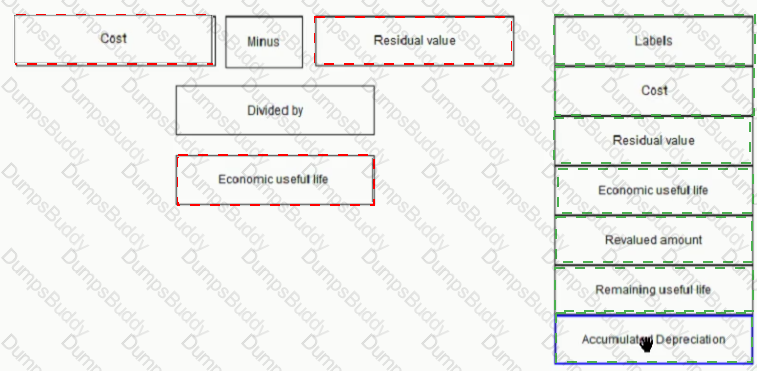

Complete the formula for depreciation of a revalued asset.

Place the relevant labels in the correct positions below.

A company is preparing its accounts to 30 November. The latest gas bill received by the company was dated 30 September and included usage charges for the quarter 1 June to 31 August of $5,700 and a service charge of $1,200 for the quarter 1 October to 31 December. It is estimated that the gas bill for the following quarter will be a similar amount.

What will be the amount of the accrual shown in the accounts at 30 November 2006?

Which one of the following is an example of where the accrual or matching convention should be applied?

A company had a gross profit margin of 40%. Sales for the period were $280,000 and opening and closing inventories were $18,000 and $16,000 respectively.

Purchases for the period were therefore

Under the normal convention of accounting, assets are shown in the balance sheet at:

One of the main responsibilities of internal auditors is to check the operational systems within their organization to establish whether the system's internal controls are sufficient and in full operation.

Which THREE of the following are examples of internal controls?

After calculating your company's profit for the year, you discover that:

(a) A non-current asset costing £2,000 has been included in the purchases account; the asset has not been included in the closing inventory figure; nor has it been depreciated by the normal 25% per annum

(b) Closing inventory of raw materials, costing £500, have been treated as closing inventory of stationery.

These two errors have had the effect of.

At 31 December year 1, the electricity expenses account had a closing accrual of $300 as a result a credit balance was brought down at 1 January year 2

During year 2, electricity invoices totaling $4,000 were paid, including an invoice for $600 for the three months ended 31 March year 3

The charge of electricity in the income statement for year 2 is $

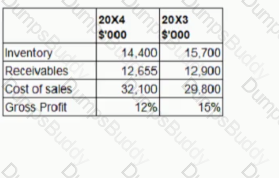

ABC produces accounts to the year ended 31 December annually Extracts from the most recent financial statements are.

Which of the following ratios is a liquidity ratio?

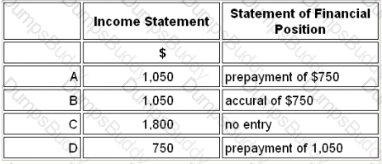

Refer to the Exhibit.

On 1 May year 1 a company pays insurance of $1,800 for the period to 30 April year 2

What is the charge to the income statement and the entry in the statement of financial position for year 1 ended 30 November?

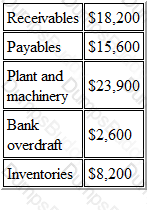

Refer to the exhibit.

Ronald has the following assets and liabilities at 31 December:

The capital balance at 31 December was

A company uses the straight line method of depreciation for its plant and machinery. Depreciation is at a rate of 20% per annum.

A major item of machinery was purchased in 2003 at a cost of $240,000. At the time, it was estimated that the plant had an estimated useful life of five years and a residual value at the end of its useful life of $20,000.

As a result of rapid changes in technology it was decided to sell the machinery in 2006 for $80,000. It is the company's policy to charge a full year's depreciation in the year of acquisition and none in the year of disposal.

What was the profit/loss arising on the disposal of the asset?

If a profitable entity is not required to register for sales tax with its local tax authority, which of the following statements is TRUE?

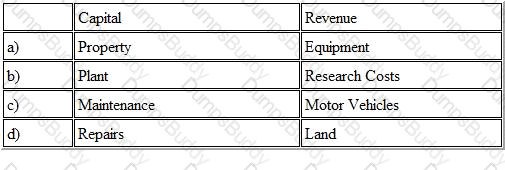

Refer to the Exhibit.

Transactions are often categorized between capital and revenue

Which of the following combinations are correct?

AB commenced trading on 1 January 20XS. introducing $50,000 cash and $15,000 of assets to the business. The profit earned and retained in the business for the year ended 31 December 20X6 was $160,000. AB's closing capital at 31 December 20X5 was $190,000.

What is the value of AB's drawings for the year ending 31 December 20X5?

Which one of the following is unlikely to be identified by the ratio analysis of a company's financial statements?

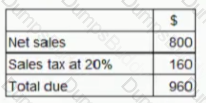

VWX is registered for sales tax in Country B A sales invoice to its mam customer shows the following information:

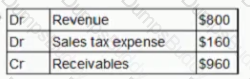

What journal entry will WVX process to record this transaction in its nominal ledger?

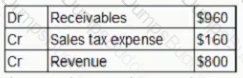

A)

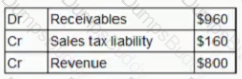

B)

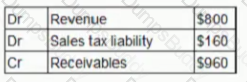

C)

D)

Which of the following transactions would be classified as a revenue transaction?

The sales ledger control account shows a balance of $267,984 whilst the individual customer account balances total $262,856.

Which of the following is a possible explanation for the difference between the two?

(i) A payment has been recorded in the cashbook but not in the sales ledger

(ii) A payment has been recorded in the sales ledger but not in the cashbook

(iii) An invoice has been recorded in the sales ledger but not in the sales day book

(iv) An invoice has been recorded in the sales day book but not in the sales ledger